Since both the topic of “money” and the topic of “the environment” are similarly vast, it comes as little surprise that the points where the two connect are too numerous to even begin to list here.

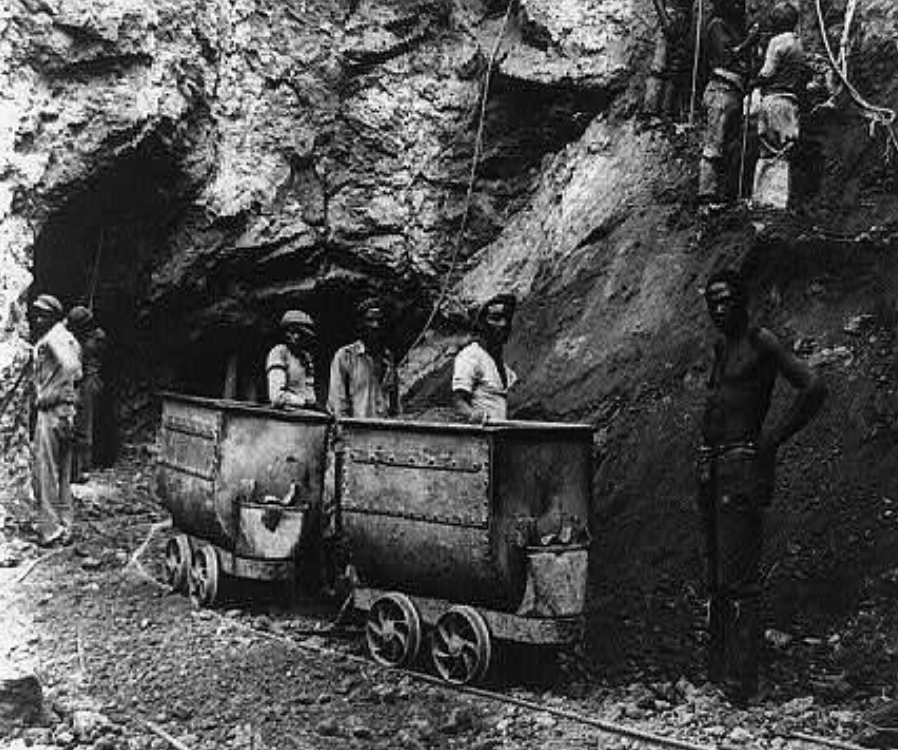

As a writer and an artist, I’m often trying to create something like an image or a relationship out of an abstract idea. Once I have that, I know I can begin to make something. In the case of a huge sprawling topic like Money and the Environment, there was a very obvious one. Was it too obvious? Maybe. But it was an image I kept on coming back to in different forms: mining. Mining is where the logic of money takes its toll on the environment in the most direct way.

Part of what makes it an interesting metaphor is that it’s not really a metaphor, or not only a metaphor. For the majority of money’s history, the value of currency has been linked with the value of a physical asset. Mostly one of two: silver and gold. An international silver standard emerged in the 16th century when the Spanish Empire “discovered” huge deposits of silver in Potosí in modern day Bolivia (then New Spain) and began to mine these. The shift from a silver standard to a gold one started in the 18th century when Isaac Newton (then Master of the Royal Mint) set the exchange rate of silver to gold too low forcing the country to switch to the gold standard, with other countries following suit. Supplies of this precious metal increased in the 19th century thanks to the gold rushes in Brazil, Australia and the United States of America. The international gold (or gold bullion) standard continued on and off into the late 20th century, and was finally abandoned by the US in 1976.